7:36

Commentary

Commentary

‘The tourists pay it’ is a lousy excuse for punishing Nevadans with a regressive tax system

What type of business generates the most sales tax revenue in Clark County, home of the Fabulous Las Vegas Strip?

If you guessed “food services and drinking places” ding ding ding you are right. It accounts for about 20% of the county’s total sales tax revenue, according to the Nevada Department of Taxation.

But how much of that food and drinking sales tax is paid by tourists, and how much is paid by locals? After all, the sales tax rate charged to a conventioneer buying overpriced steaks in a restaurant on the Strip is the same as that charged to a single mom buying a Happy Meal in Henderson.

And a lot more people resemble the latter than the former. A metro area with 2.3 million residents is a city, not a tourist town. And almost a million people live in the rest of the state. Assuming locals don’t provide the vast majority of sales tax revenue in Nevada is absurd.

Meanwhile, the other 80% of the county’s total sales tax revenue comes from other businesses, including the type of business that comes in second, with an impressive 12% of the total: “Motor vehicle and parts dealers.”

Does anyone doubt that the amount of that sales tax paid by tourists is anything other than itsy-bitsy compared to the portion of it paid by Nevadans?

The old argument that the sales tax is good policy because we’re “exporting” the sales tax to tourists is an indefensible myth that’s past its sell-by date.

But whether deliberately, ignorantly, or habitually, some still cling to it.

And that lingering misperception still serves as a rationalization for a deeply unfair tax structure in which the regressive sales tax is the largest single source of state general fund tax revenue.

The moral and intellectual vapidity of Nevada’s tax structure made a rare legislative appearance recently, thanks to a resolution sponsored by Democratic Assemblywoman Natha Anderson. It would require “a study regarding wealth taxes” between now and the 2025 legislative session.

Nevada is one of only a handful of states where the constitution prohibits a personal income tax. So one of the things the study would have to include is “an examination of what types of wealth may be taxed in this state.” Wealth, after all, isn’t income.

But Anderson’s study bill, which survived a committee vote Wednesday night and so will move on, is not really what this is about. This is about the effect the proposal had on Republican legislators during its initial hearing.

Nutshell: They are offended by the suggestion that Nevada’s tax structure isn’t practically perfect in every way.

Won’t someone think of the rich?

Discussing Anderson’s resolution during a hearing last week, Republican members of the Assembly Revenue Committee were really quite miffed at the assertion, stated right there in the resolution’s first “WHEREAS,” that Nevada’s tax structure “is regressive and unfairly burdens low-income Nevadans.”

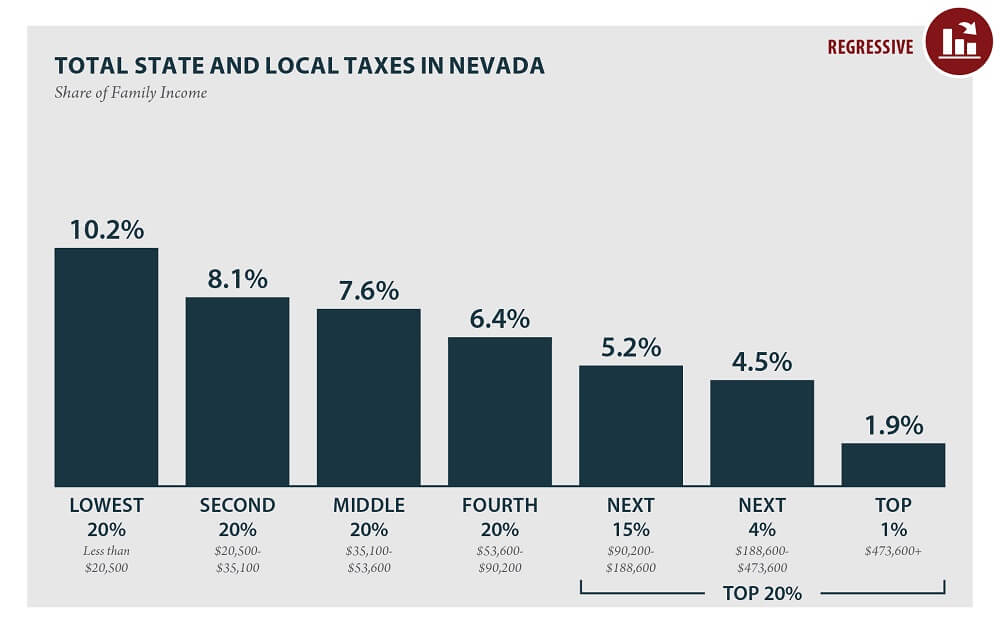

In an admission of incomprehension – “it makes absolutely no sense to me” – that would be echoed by other Republicans on the committee, Nye County Republican Assemblyman Greg Hafen blasted a report from the Institute of Taxation and Economic Policy (that regular readers of my columns have seen before) showing that the poorest 20% of Nevadans pay more than 10% of their income in state and local taxes – double the highest relative burden on the top 20%.

How, Hafen huffed and puffed, can the tax burden be 10.2% of income on the lowest 20% when the sales tax rate is only about 8%?

The sales tax in Clark County is the state’s highest, at 8.375%. In often interesting albeit usually not in a nice way Nye County, it’s 7.6%. Both of those are lower than 10.2%, so let the record show that Hafen can capably compare numbers and determine which is bigger.

But the ITEP analysis is an estimate of total state and local taxes as a share of a family’s income.

Sales taxes aren’t the only state and local taxes that might be paid by people in low-income households, a fact that obviously eluded Hafen at the time.

It’s particularly curious, for instance, that neither he nor any of the Republicans at the hearing brought up the 24 cent per gallon Nevada gas tax – especially since their fellow Republican in the governor’s mansion, during his state of the state address, made a big deal out of his big idea to give everyone a gas tax holiday.

Nor did the usually tax-sensitive Republicans acknowledge multiple other state and local taxes that might be paid by low-income households, including but not limited to a cell phone/wireless tax (3.4%) and the especially onerous of late local government fee on gas & power bills (5%).

And perhaps Hafen and other Republicans won’t begrudge low-income earners who, after working a shift at one job and then a shift at another on the same day, might want to wind down with an edible when they finally get home. The state retail tax rate on cannabis is 10%.

Another Republican on the committee, Assemblyman Ken Gray, confided that the discussion of a wealth tax “touched on something…that drives me up a wall every time I hear about it: Equal tax share, fair tax share, things like that.”

Oh yes, well, things like that.

The rich, Gray gushed, pay more sales taxes because they buy more things because they have more disposable income.

In other words, reflecting a Republican fondness for walls, Gray has erected one between himself and the concept of effective tax burden as a share of income. Which is to say the assemblyman doesn’t know what the word “regressive” means. Or if he does he doesn’t care.

Gray also noted that rich people are super nice because “they usually take nothing from the system.” Which is true! If you don’t count the roads they drive on. Or the schools that educate their workforce. Or the law enforcement industrial complex that has no higher calling than protecting rich people and their property. Or the health care for people who aren’t provided any by their employers (who might be rich people who pay lots of sales taxes). But yeah other than – to borrow Gray’s phrase – things like that, rich people take nothing from the system so we should give them all cupcakes or whatever.

Republican Assembly Minority Leader P.K. O’Neill echoed Gray’s admiration of rich people who pay more money in sales taxes when they buy a new Mercedes than low-income people pay when they buy a used Kia. Rich people, bless them, buy more and better and more expensive things, O’Neill observed.

That’s because they have a lot more money, as O’Neill knows. That means that the sales taxes they pay as a portion of their overall income are much less than the portion paid by low-income people, a simple fact which is a) illustrated in ITEP’s chart and B) pretty much the definition of regressive. As O’Neill maybe does not know, or knows but doesn’t care.

And then O’Neill also made the argument – the old, old, argument that’s been dusted off by defenders of the state’s unfair tax structure for decades whenever the subject comes up – that the sales tax is dreamy because tourists on the Las Vegas Strip pay so much of it.

In other words, O’Neill’s bought the myth.

Putting the money where their mouth is

Even if the myth was true, and tourists accounted for a majority of sales tax revenue (which they don’t), would that justify punishing Nevadans – throughout not only all of Clark County but all of the state – who pay the 7th highest base sales tax rate in the nation?

Since the overwhelming majority of sales tax revenue – regressive sales tax revenue that hits you harder the less money you make – is not paid by tourists, but by Nevadans, policymakers should respect those Nevadans – those taxpayers – or to use a term politicians revere, those stakeholders – and stop pretending otherwise.

And if they’re so convinced tourist sales tax revenue is All That, let them put all that money where their mouth is: Keep the 8.375% sales tax rate – in the Strip corridor, and lower it everywhere else.

Hafen, Gray, O’Neill and their legislative Republican colleagues might even want to co-sponsor such a proposal when legislators careen into budget negotiations in a few weeks. Republicans are fond of tax cuts. Or so they say.

C’mon Republicans. Not only could you adhere to your oft-stated principles. You could also see if Democrats would oppose an obvious and long overdue move toward tax fairness.

Our stories may be republished online or in print under Creative Commons license CC BY-NC-ND 4.0. We ask that you edit only for style or to shorten, provide proper attribution and link to our website. AP and Getty images may not be republished. Please see our republishing guidelines for use of any other photos and graphics.

Hugh Jackson