5:29

News Story

Businesses bailing on NV because of new paid leave law, economic development officials claim

A new paid family medical leave requirement for companies receiving tax breaks from the state continues to receive pushback from economic development officials, who say the policy is hindering their efforts to relocate and expand business in Nevada.

In order to qualify for tax abatements through Nevada Governor’s Office for Economic Development, companies with more than 50 employees must provide paid family and medical leave to workers who have been with their company for one year or longer. The requirement stemmed from a bill that was vetoed during the 2023 Legislative Session but resurrected as an amendment to the Oakland A’s public assistance package bill, which was passed via a special session in June.

The federal Family and Medical Leave Act, better known as FMLA, is unpaid and only protects qualified workers from losing their job for 12 weeks. Nevada’s new law requires the tax-abated companies to have a paid family and medical leave policy that pays workers at least 55% of their salary for up to 12 weeks.

Such leave is used for myriad reasons, including for maternity leave after giving birth, or to take care of aging parents or sick spouses.

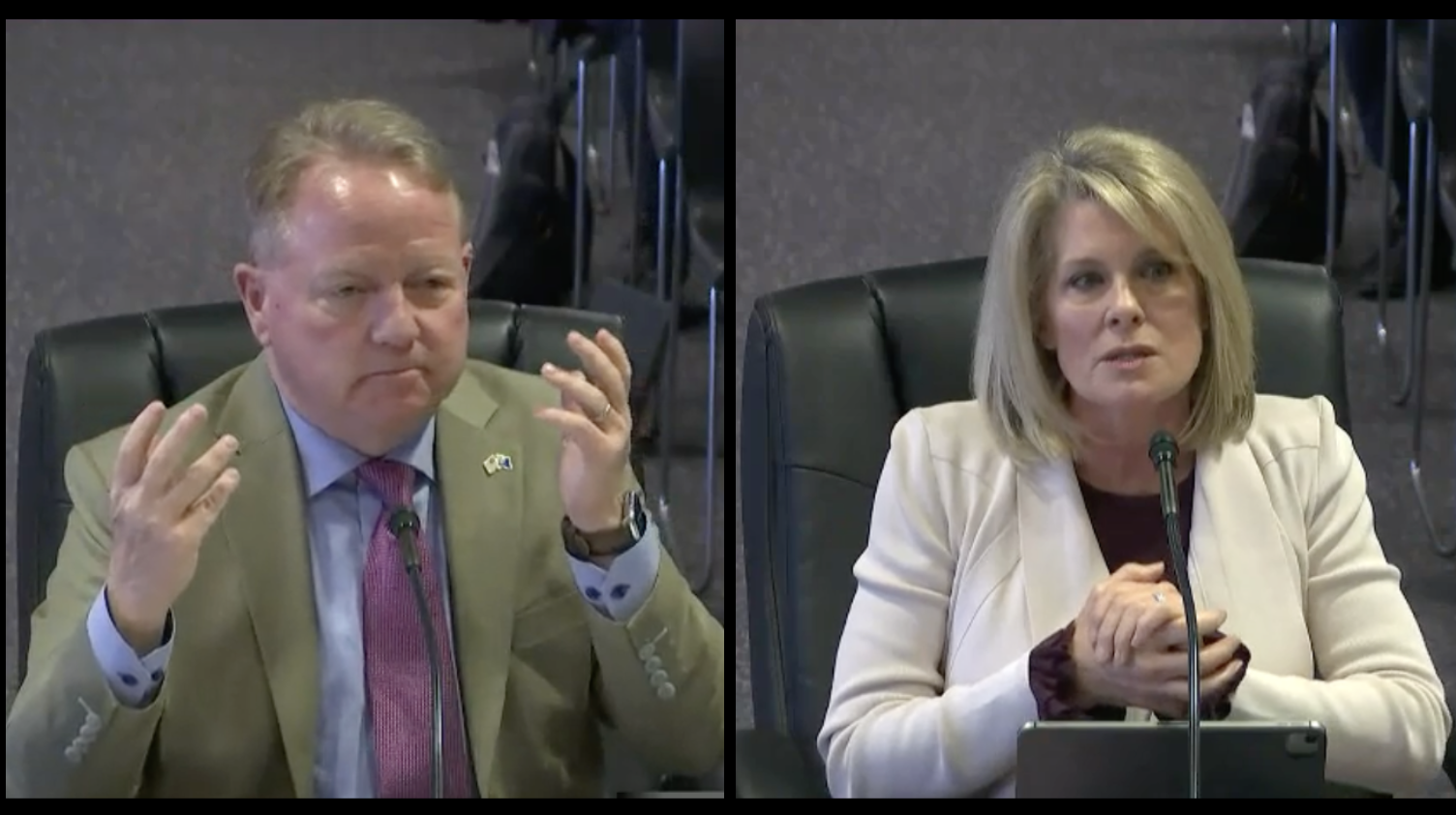

GOED Executive Director Tom Burns told lawmakers on an interim revenue committee Wednesday that the new paid family and medical leave requirement has brought with it “some headwinds.”

It was “the tipping point” in one company’s decision not to relocate their headquarters in Southern Nevada, according to Burns.

“They have another 150 employees nationwide. They’re not willing to provide a benefit to a set of folks in one state and not having it in another state,” said Burns. “So they have elected to move their headquarters (elsewhere).”

He added, “We’ve had other similar conversations.”

Burns did not name the company, and a spokesperson for GOED told the Current the agency could not disclose the name without that company’s approval, due to nondisclosure agreements.

Las Vegas Global Economic Alliance President and CEO Tina Quigley, who also presented to the revenue committee, echoed Burns’s concerns, saying they too were starting to see the impact of the new paid family and medical leave requirement.

“(It) is above and beyond not only the federal standard but also even the California standards, which makes it tough to even encourage the California companies wanting to leave,” she said.

Thirteen states, including California, and the District of Columbia have mandatory paid family and medical leave laws that apply to private employers, according to the Bipartisan Policy Center. Structures vary by state. Nevada has no statewide policy.

The paid family and medical leave provision of the A’s special session bill went into effect on Oct. 1, 2023 — meaning companies had a window of several months after the bill’s passage in June to apply for tax abatements and avoid the requirement.

“We had several companies put in applications prior to the deadline and we’ll start to see them come through the GOED process here in the next couple quarters,” said Quigley. “But we are starting to see GOED requests dry up.”

State Sen. Edgar Flores, the Las Vegas Democrat who sponsored the paid family and medical leave bill that was vetoed then negotiated into the special session bill, could not be reached for comment before this story was initially published.

However, after the story was published Friday he issued a statement responding to the presentations provided to legislators by Burns and Quigley.

“To claim businesses, without saying which, refuse to come here because they do not want to give workers earned time off, signals that we are not attracting the best business partners,” Flores said.

“If these companies do exist, we deserve to know who they are and if they are complying with paid family medical leave in other states but refusing to offer the same to Nevadans. The research supports the benefits for workers and businesses and we should expect businesses that want handouts in the form of abatements from our state to treat workers with dignity,” he said.

“Many small businesses in Nevada who do not qualify for these abatements offer their Nevada workers paid family medical leave,” he said, adding “the least we can demand” is “the same from new partners coming in.”

During last year’s legislative session Flores defended his policy as being both “pro-business and pro-family.”

“We know that we have an obligation to take care of folk,” he said during a bill hearing in May. “It’s what Nevadans do. It’s what good strong small businesses do. We do it because it’s a best practice. It’s how we retain and take care of our workforce. What we’re saying through this bill is, if we’re attracting businesses to Nevada, we’re also attracting businesses that are like-minded.”

Flores’s bill passed with bipartisan support before being vetoed by Gov. Joe Lombardo, but was enacted as part of the baseball legislation.

Other benefits questioned

State Sen. Fabian Donaté, D-Las Vegas, during the interim revenue committee questioned GOED’s leader about health care requirements and whether companies are providing adequate enough coverage. He pointed to Amazon, which has received tax abatements from Nevada, being the state’s top employer of Medicaid enrollees.

Tesla, which has received two of the largest Nevada tax breaks ever awarded, is ranked 11th on the list of large employers with the highest numbers of employees in the state enrolled in Medicaid.

GOED’s tax abatement programs require businesses to cover 65% of the employee’s health care insurance premium. For comparison, the Affordable Care Act requires employers to pay for 50%. (There are no requirements for covering dependents of employees.)

Burns said that, because the ACA does not penalize people who opt out of their employer-based plans, many decline coverage rather than pay their 35% portion of the premium.

“I’ll just (refer) back to my days when I was in my 20s,” said Burns, who prior to joining GOED spent three decades in the insurance industry. “I’d rather have beer money than pay for health insurance. … There are just folks that don’t take it. And they’re not required to. Those people naturally could still fall under Medicaid provisions.”

Donaté pushed back on the characterization of Medicaid enrollees spending money on beer instead of health care.

“It’s not a decision of, ‘I’m not going to choose health insurance because I don’t want it at this moment,’” he said. “They are choosing health insurance, and their employer is obviously not the one they’re choosing it through, because it’s either too expensive or there’s just no means to do so.”

A $50 per month premium, or $200 per month for family coverage, could be a barrier for these workers, especially in light of the rising costs in housing, food and other necessities.

“They are obviously qualifying for Medicaid,” Donaté added. “Their employer is not paying them their fair wage.”

He suggested a higher threshold of coverage provided to employees might be more appropriate for companies receiving economic development tax abatements, because the state will have to pick up the cost of Medicaid for their employees.

This story was updated to include reaction from state Sen. Edgar Flores.

Our stories may be republished online or in print under Creative Commons license CC BY-NC-ND 4.0. We ask that you edit only for style or to shorten, provide proper attribution and link to our website. AP and Getty images may not be republished. Please see our republishing guidelines for use of any other photos and graphics.